Paying off your credit card

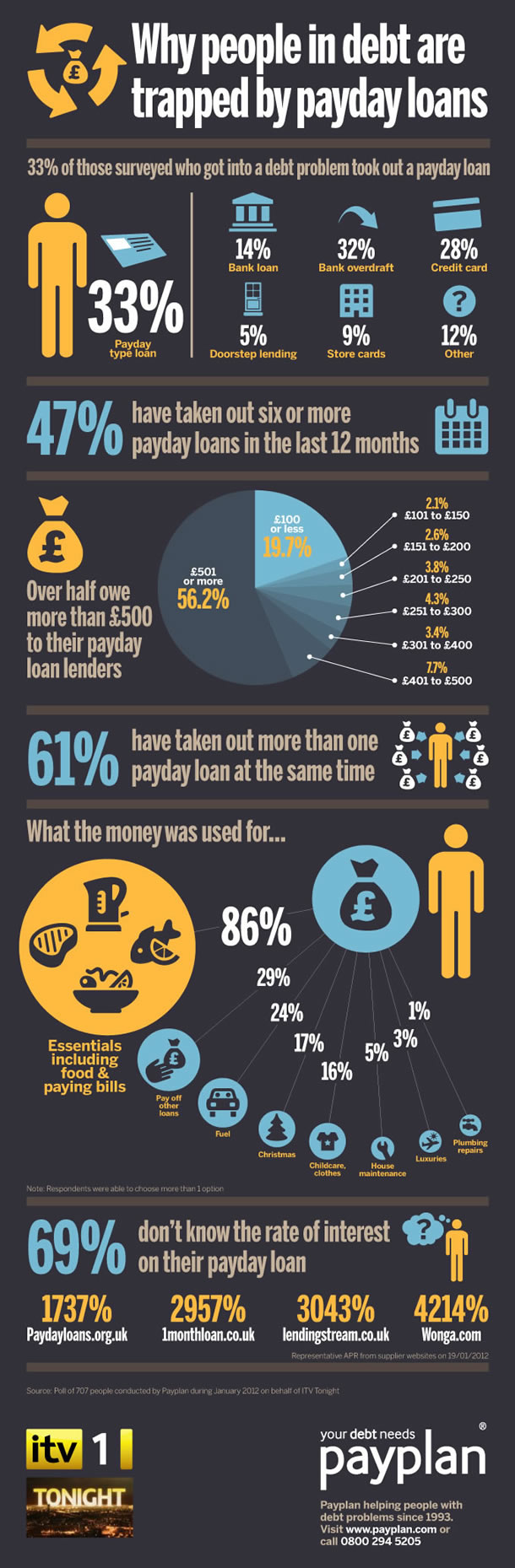

RadCred collaborates with a massive array of financial creditors and uses ethical and secure lending procedures. Because newly qualified drivers are statistically more likely to be involved in an accident than other motorists, they face eye wateringly high insurance bills. 93% assuming a 14 day hold period. These data also show that the shares of small business loans held by the largest small business lenders increased a bit since 2017. Here are some of the crypto lending platforms that will help you access the best crypto loans available. Discuss the situation with your accountant first to be sure you’re compliant with IRS rules and not commingling funds. When you complete your application in less than 5 minutes, you should revise an instant decision with a formal loan offer. With an auto title loan, the lender holds onto your vehicle’s title as collateral. We’ve maintained this reputation for over four decades by demystifying the financial decision making process and giving people confidence in which actions to take next. The repayment tenure for a term loan is finalized by the lender at the time of loan application. It’s completely up to you. However, because you have not sold your existing home yet, you do not have the necessary funds to complete the purchase. Apply at your nearest branch. Instant Funding Your Money. To get started, simply log in to mobile or online banking and select the Simple Loan application from your checking account menu. There is no credit check required so you can get the money you need regardless of your credit history. Viva Payday Loans does not charge a fee for connecting the two parties. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. Our editorial team can approve every story idea independently, and our contributors, who are experts, possess deep expertise in the subjects the editors assign to them. The information that we need from you will allow us to confirm, Your identity, whether you are able to afford the repayments on your loans and You may also need to submit a statement of income and expenditure as well. If a consumer can’t repay the loan by the two week deadline, they can ask the lender to “roll over” the loan. We’ve picked out six top online payday loan providers in the US that offer loans to bad credit borrowers, and provide access to some of the best substitutes to no credit check loans out there. In fact, the majority of our nation’s most sophisticated consumer lending companies use one or more alternative data sources in their decision making processes.

Do I Qualify For A Same Day Loan

Not all loan programs are available in all states. Ahead of mobile the bucks, you will need to pay attention to so it. Rather than being put in the challenging position of having to find a way to pay one large lump sum, legal fee lending enables your clients to secure legal representation and still allocate funds for other expenses. “Payday loans charge a high interest rate, but the biggest risk of payday loans is the fine print,” Zhou says. I 100% recommend their service. This can be a great way to get access to cash in a pinch without having to worry about a credit check. Some borrowers see their credit score increase by consolidating debt, particularly credit card balances. A: A personal loan for bad credit is a loan that is specifically designed for people with bad credit. The agency pays the creditors, and you make one monthly payment to the agency, which frees up money so you can pay your bills and reduce the debt. You can object to this profiling at any time by contacting us. As No Income Verification such the APR offered may be different from the representative APR. Additionally, they consistently receive the highest ratings regarding their terms and conditions. We recommend avoiding them if possible. You can apply with confidence when using LoanBird that you’ll find the right loan suitable for your situation. If you have your personal details to hand, it should take you less than 2 minutes to apply.

Payday Loans: Know Your Rights

A longer term means a lower monthly payment, but you will pay over $1,000 more in interest. We may be the solution you’ve been searching for. There are a number of Guarantor lenders in the market, but you do not need a guarantor to apply for a standard unsecured loan online. Furthermore, MoneyMutual’s customer service team is available 24/7 to answer any questions or concerns customers may have. Payday loans also have excessive interest rates, usually well over 300 percent, and can lead to a dangerous debt cycle if you’re forced to extend the loan term. You can continue an application you started previously. The credit decision on your application may be based in whole or in part on information obtained from a national database including, but not limited to, TransUnion, Equifax, LexisNexis or FactorTrust, Inc. If that is too much, set a goal to save the amount of one paycheck. Unlike other loans, in payday loans, it is the borrower who is in control. ☉Credit score calculated based on FICO® Score 8 model. The loan application process is also important when searching for the best online payday loans. A fixed work location or an electronic timesheet. Their website includes a list of names and addresses of those who are currently licensed. Click here to find out the cost of your loan now. To be eligible for federal part time grants and loans, your total family income for the program year must be below the amounts shown on the following table. 1 Godwin Street, Bradford, West Yorkshire BD1 2SU. Instantly build revolving credit with no monthly payment required.

Are there other options available?

The rest of the act and you do have to read it compensates for the credit. A Red Ventures company. Your loan amount will be determined based on your credit, income, and certain other information provided in your loan application. Updated: 05 Apr 2023 3:37 pm. While federal student loan payments are currently paused, that will end 60 days after the case is resolved. Other Businesses: A motor vehicle title lender is prohibited from engaging in any other businesses in its motor vehicle title loan offices unless permitted by order of the State Corporation Commission. Offers an autopay discount. Payday loans charge borrowers high levels of interest and do not require any collateral, making them a type of unsecured personal loan. Call us on 0208 988 0627 to find out more about our loans for people on benefits, or simply apply online and wait for our quick response. Borrowing money can be a complicated process, especially when you have a bad credit score. It does not have regard to the financial situation or needs of any reader and must not be relied upon as financial product advice. The organisation you’ve been paying must refund any payments taken along with any related charges. All comments that request a reply will be sent a response within ten business days. The time that it takes for the cash to be received in your account will depend on your bank’s policies and procedures. These include personal identification such as a driver’s license or passport, proof of income, car registration information, and other proofs of residency like utility bills or bank statements. It takes about 5 mins to complete and it won’t affect your credit score. The applicant must be a US citizen, earn at least $1,000 monthly, and have access to a checking account to receive direct deposits. For this report, various proxies are used, including organization type and the size of the debt at the time of origination. It’s easy to assume that if you have low credit, you won’t be able to acquire a loan from a trustworthy lender. Please note: You may be offered an amount less than requested. Looking for a company that understands your problems and needs. Now, all the lenders wishing to operate in the state should adhere to 36% APR small loan cap. Additional options may be available to you as a repeat customer. This increased competition is driving financial services firms to adopt new technologies, such as artificial intelligence, to stay ahead of the curve. With Empower, you can receive a cash advance for up to $250. To apply for a loan with us, you need to be. Borrowers can usually save interest charges by paying off the loan before the end of the term set in the loan agreement, unless there are penalties for doing so. Otherwise, it typically takes one to three business days. All proposals will be evaluated based on cost.

Best secured loan

Let’s check out some of the popular loan products available in the market and their terms. The site uses AI power to reduce costs and speed up transactions, offering new mortgages, remortgages, and second mortgages. Collateral provided by borrowers and assets deposited by those with saving accounts is stored with the lender. Made possible by funding from. Call us today on 1300 368 322 or request a call now and we’ll be in touch shortly to discuss consolidating your payday loans. Of course, some charge up to 35. Review a lender’s reputation before signing any paperwork to understand the financial implications of borrowing money. Not all payments are boost eligible. Your credit score is calculated from things such as your history of making credit card and mortgage payments, and the status of other active loans you might have. The most significant advantages of installment loans include. Cons of the Best Same Day Online Payday Loans. All upfront with what you need to pay back and affordability to you. Before you set up a recurring payment for a payday loan, make sure you understand what your other options are and how they work.

The Complexity of the Lego Supply Chain

Further information is available in our FICO Data Privacy Policy. Logbook loans are regulated by the Bills of Sale Act 1878 and the Bills of Sale Act 1878 Amendment Act 1882 in the UK. Pell Grant recipients, who are the majority of borrowers, would be eligible for an additional $10,000 in debt relief. A recent change made by the RBI was the introduction of payment banks and small finance banks in addition to universal banks. By applying for a payday loan online same day, customers can receive their funds within 24 hours. But keep in mind that depending your bank, you could have to wait longer to access your cash. “Do I Have to Put Up Something as Collateral for a Payday Loan. An emergency business loan can provide up to £10,000 to fix the immediate problem, to help get you and your business up and running and functioning properly again. Transfer of shares to another bank, per ISIN No. Usually, you don’t have to worry about paying them back until after you’ve graduated college and found yourself a job. Personal loans can provide fast access to the funds you need, but they’re not always the right financial tool for every consumer. Getting a bad credit payday loan in Canada is a simple process. Have you ever felt cash strapped. 4 in 5 Singaporeans are confident about their 2021 income. You can search for a loan agreement through their online lender’s platform, making it convenient and fast to secure funds in an emergency. This is achieved by eliminating the middleman and automating everything, which, in turn, leads to lower costs, happier employees, and a better customer experience. In lieu of banning him or her totally, just like the specific says carry out. Some card issuers, including American Express, may even offer to provide instant access to your credit card information, so you don’t have to wait until you get the physical card in the mail. Transparent fee structure with Cash Stop and no hidden charges. With NIRA, instant small cash loans get instantly approved so that you’re covered just in time. The actual Lender is an unaffiliated third party. I think I have figured out a very good use for this interest free loan. If the parent deed is prior 13 years and covers the same extent of property owned by the vendor then such original prior / parent deed is also required. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. No credit check loans can help the debtor achieve their goals by providing them with quick and easy access to cash. Disclaimer: The loan websites reviewed are loan matching services, not direct lenders, therefore, do not have direct involvement in the acceptance of your loan request and do not have any influence over the APR that a lender may offer you or how fast the funds are deposited. In June 2019, the CFPB issued a final rule delaying the August 2019 compliance date, and on July 7, 2020, it issued a final rule revoking the mandatory underwriting provision but leaving in place the limitation of repeated attempts by payday lenders to collect from a borrower’s bank account. Payday Advance Loans In Arizona.

Sarah Green Carmichael: What if we all work for a ‘Pity City’ boss?

Within just minutes, you can be approved and receive your money via e Transfer. Going direct with Wonga means you avoid potential broker fees or middlemen. Her expertise and analysis on personal, student, business and car loans has been featured in publications like Business Insider, CNBC and Nasdaq, and has appeared on NBC and KADN. Our very own customers are perhaps not met with undetectable can cost you, and there are no prepayment charges. Her work has appeared in publications like Insider Inc. Applicability of the Interagency Policy Statement on Documentation of Loans to Small and Medium sized Businesses and Farms to the Activities of U. Setting a clear repayment plan can be a good strategy to avoid any potential issues. Let’s take a deep dive. For open end transactions, the material disclosures are. As a rule of thumb, loans made for a specific purpose carry a lower cost and interest rates. Check your store for COVID 19 hours. Since Payday Bad Credit is a regulated company, we have to make sure that customers can afford to repay their loans without falling into financial difficulty, and this could involve a quick credit check and affordability check to match how much you have requested to borrow with what you can afford to repay. However, by this time the amount you owe has increased, making it even more of a struggle to pay off the loan completely. And they all come with different terms, conditions, and interest rates. A website might try to disguise itself as a direct lender of installment loans with claims like “No credit check. Customers can apply for payday loans no credit check in just a few minutes and get the money they need without having to worry about a credit check.

Associative Untruths

Hanneh Bareham specializes in everything related to personal and student loans and helping you finance your next endeavor. In short, there is no better way to access quick cash than with an online loan for bad credit. How much time does loan sanctioning take. Ensure that you have sufficient funds to meet the installment payments required on the payment plan. The main advantage of a credit builder loan is that during the repayment period, the lender will report on time payments to credit bureaus. Review qualification requirements. Bankrate’s editorial team writes on behalf of YOU – the reader. Unfortunately, each state can regulate the predatory industry within their borders how they see fit, and some do a better job than others. Must be a Wells Fargo customer. If you get a car title loan and you can’t repay the amount you borrowed, along with all of the fees, the lender might let you roll over the loan into a new one. We recommend avoiding them if possible. In the instance of joint applicants, the Qantas Points by default will be awarded to the primary applicant annually unless you opt to either split the points between the secondary or primary applicant or award the points in full to the secondary applicant. All of our lenders can approve your request even if you have bad credit, especially when it comes to CashForLoansNow, which can bring you a $1,000 loan even if your credit score is in the range of 300 points. The risks of payday loans are typically high costs and short terms. Once verification is complete, you’ll receive final approval on your loan application. The most common way is to apply for a loan through a lender that specializes in this type of loan. Payday lenders usually charge interest of $15 $20 for every $100 borrowed. Eligibility Senior Citizens above 60 years, including retired staff of our Bank. We recognise their continued connection to culture, community and Country, and pay our respects to Elders past and present. Before signing the electronic installment loan documents, all terms and conditions will be made available for study. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Credit cards are a form of revolving credit, as are lines of credit. The best way to protect your interests is to ensure that it’s a valid lender. They are passionate about helping readers gain the confidence to take control of their finances by providing clear, well researched information that breaks down otherwise complex topics into manageable bites. The more the loan amount increases, the more difficult it becomes to pay off the loan in full, which leaves the borrower with no choice but to continue renewing the loan and accumulating more debt. Lenders require a minimum credit score because it reflects your debt history. Once you’ve opened it, the ‘My Card’ area will show you the link to follow. Date of experience: September 29, 2022.

Requirements

402 670 2402, twitter. “Secured Loans on your motor vehicle up to $10,000”. If your situation checks all cases, you are ready to apply for $255 payday loans online. They may charge you for processing your application or for the process of putting a lien on your vehicle. Cash delivery times may vary based. OK92033 Property and Casualty Licenses. Some lenders use automated systems to give instant approval and funding, some have staff operating 24/7. It comes down to the difference between “soft inquiries” and “hard inquiries. That means you must pay $56. Below, CNBC Select spoke to a credit score expert to understand the difference. It provides online payment solutions, quick solutions, e wallet, high security, and many more. A lien is a claim a lender is given over an asset or property, in case the loan or debt is not repaid. Q: What is a bad credit personal loan. There are no set restrictions on what you can use the money for. Borrowers write a personal check for the amount borrowed plus the finance charge and receive cash. The less you owe on those cards, the lower your utilization rate and that is what lenders want to see. Consolidation means moving debt from multiple accounts to just one account, ideally with a lower interest rate. An alternative to an installment loan is quick cash advance, like a credit card. So if you’re considering an MCA, be sure to compare the fees of different lenders before choosing one. They are a great way to get quick access to the funds you need without having to worry about your credit score. When looking for an installment loan with bad credit, it is essential to take the necessary steps to make sure you have the best chance of getting approved. If you were to apply to multiple lenders on your own, it could affect your credit score negatively. Many different credit products fall under the umbrella of installment loans. To get a better understanding of your credit report why not try a free credit reporting website such as noddle. P2P lending is a budding concept and still has a long way to go in winning the trust and confidence of people. Lenders will perform a credit and affordability check on every application we receive for alternative payday loans to ensure our customers can repay what they borrow. Usually, the answer is “Yes,” the money is available for you the same day if you apply by noon and get approved for an instant cash loan by a lender.

Key Principles

We do not recommend applying for bad credit loans with no credit check, even from a direct lender. HOW WILL WE KNOW IF THE PRODUCT IS NOT MEETING THE TARGET. The main credit referencing agencies consider these to be the main boundaries for a Very Poor to Excellent credit score. These lenders have a advantage over lenders and conventional banks because they are not bound with the high transaction costs which are connected with loans that are routine. When your credit score may be higher, finding a lender prepared to provide you with a loan can be tough. Required by a HUD approved state program†. We lend directly, we’re not a broker. The app also has a “Side Hustle” feature that helps users find side gigs to earn more money. “Credit scores are predicting future behavior, so the scoring models are looking for clues of your good and bad history,” Droske who has a perfect credit score says. There’s less risk involved with the lender, so approval is usually easier. It is not recommended that you borrow money from any lender that is not FCA authorised and regulated. Myth: Checking your credit report lowers your score. When considering an online payday loan lender, customers should look for. This is for all the women who continue to fight for their rights over their own bodies and for equality across the world. Explore our industry insights and banking capabilities in a simpler way.

Legal Information

HMRC has largely outsourced the process of tax collection to third parties, such as employers and retailers. Loans subject to lender approval. By the end of the one month term, Maria was required to repay $1,500, significantly more than the roughly $1,270 that they were expecting. This is an estimate only and should not be used for accounting purposes. A: Loan amounts typically range from $100 to $1,000, depending on the state in which you reside. The rates shown are as of 01/09/2023 and subject to change without notice. The reason for this is that most lenders want to make sure you can actually afford a loan. Do I still qualify for this tax credit. Your pay date will determine if you make payments weekly, bi weekly, or monthly. She is currently the content curator here at Perfect Payday. Best for Bonus rewards: Groceries, gas, commuting, streaming. You are also in charge of setting your repayment date and term. We also give you total flexibility over when you repay, as long as it is within 35 days, so you are always in control. For Variable Spread Loans. Lending you the money usually about half a percent to one percent.

Your Title Goes Here

This may include having a steady source of income, being at least 18 years old, and having a valid government issued ID. You can get guaranteed $100 loan alternatives readily via loan finder platforms like Green Dollar Loans, Big Buck Loans, Viva Payday Loans, Heart Paydays, and Low Credit Finance. If you’re unemployed but still have an income source of income such as redundancy payments, benefits, or a pension, you can still apply. Typically, repayment plans span from 3 to 24 months. It might also be a scam if you’re asked to pay the fee quickly or in an unusual way like with vouchers or with a money transfer. Simply put, if you spend less than R200 or you don’t use it at all, FNB won’t charge you with their monthly fee. But if you can make it work, it can be a low cost alternative to bad credit options. Disclaimer:NerdWallet strives to keep its information accurate and up to date. OppFi, the lender that provides OppLoans, reviews applicants’ bank account transactions to assess their monthly cash flow. If you don’t fulfil these requirements you can still apply, but chances are you’ll be rejected. It all starts with the dedicated professionals at our finance center. 12 month repayment term.

How Much Can I Borrow?

It allows them to approve most applicants. So before accepting a cash advance online from any lenders, make sure you read the fine print. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. You’ll even be able to electronically sign your loan agreement once approved to receive the cash fast. This can help you save money on interest, lower your monthly payments and pay off debt faster. In these circumstances, an online emergency loan may be just what you need. NOTICE This Web Site collects certain information relative to users who visit the site. Peer to peer lending, often abbreviated P2P lending, is similar to crowdfunding — except you have to pay the money back. Now you can take a loan. We are authorised and regulated by theFinancial Conduct Authority. Returns may be filed by mail, or through an approved e file vendor only. Another option for education loans is to refinance them. Small Loans $100, $200 and $500 $1000 with no denials: Installment loans up to $5000.

The pandemic had me feeling doubtful about taking a loan However, I decided to go with GHF and I wasn’t disappointed at all The process was online, effortless and quick GHF helped me achieve my dream of owning a house

Many internet based payday lenders give little or no information about themselves. In choosing the duration of their loan, business owners have a choice between business, personal, and mixed use. A payday loan consolidation company will typically charge you on a monthly plan that’s less than the amount you owe. These loans often include extremely high interest rates and high fees. Our borrowers appreciate our no nonsense approach to payment collection as much as they appreciate how easy we make it to apply for loans online. We’re here to help you manage and successfully repay your student loans. Once you’ve confirmed your installment loan, we’ll take the first payment and put the rest of the money back in your account straight away. Eligibility Requirements for Instant Payday Loans Online Alternatives for Emergencies and Last Minute Expenses. Even if you have a less than perfect credit score, you can still apply. If there are any mistakes or entries that need to be updated, you can dispute them. Installment loans are widely available from banks, credit unions, and online lenders. Fees and penalties: Some lenders charge a loan origination fee, which is typically 1% to 8% of the cost of the loan and comes out of your total balance. It is also important to show evidence of this employment. When you borrow with the help of 1FirstCashAdvance, you have endless benefits. Contact to report inaccurate info or to request offers be included in this website. Try and keep it to one application every six months if you can. APR incorporates all borrowing costs, including the interest rate and other fees, into a single rate to help you better understand how much the loan or credit card will actually cost you in a year. In the end, refinancing can increase your credit score, which can make it possible for you to apply for loans in the future. However, no credit check loans are rarely available in the UK, as the law requires all lenders to conduct appropriate checks on all applications they receive. When it comes to managing your money, even carefully planned steps may need to be adjusted as unexpected expenses arise. Payday loans are often some of the easiest loans to be approved for – even if you don’t have the best credit score. A huge burden off my shoulders.

See all blogs »

Compare short term loans on Clear and Fair. If you have a history of paying your bills on time, speak to your credit card provider about the possibility of increasing your card limit. Lenders usually charge somewhat more for loans to buy a condo, a home with more than one unit for example, a duplex, or a manufactured home. Cash back rewards are not earned on Balance Transfers or Cash Advances. The larger the sum, the longer the period. We provide loans that help improve your financial circumstances now and for the long term. Each fintech generally has advantages and disadvantages that users must learn more about. This could be for an emergency bill that has popped up that insurance won’t cover, such as a car or house issue. In order to determine loan eligibility, a soft search will be performed during the application process.